Insurance deductibles are one of the most misunderstood yet financially impactful components of any insurance policy. Whether you are purchasing health, auto, home, or travel insurance, the deductible you choose directly affects your premiums, out-of-pocket costs, and long-term financial protection.

This guide explains what insurance deductibles are, how they work, and how to choose the best deductible for your financial situation—especially in Tier-1 countries like the United States, Canada, the United Kingdom, and Australia.

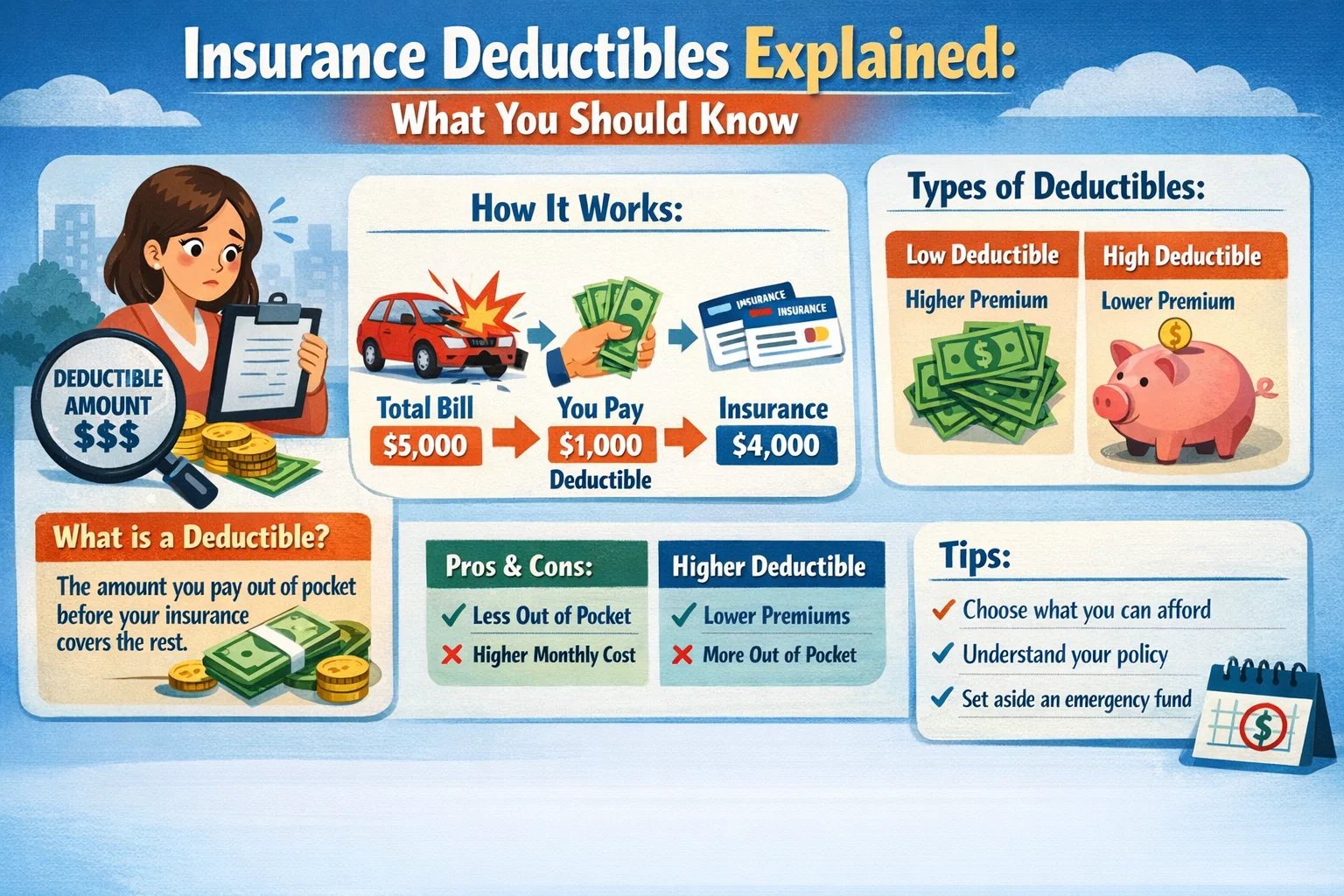

What Is an Insurance Deductible?

An insurance deductible is the amount you must pay out of pocket before your insurer begins covering eligible expenses.

Example: If your deductible is $1,000 and your claim is $5,000, you pay $1,000 and the insurer pays $4,000.

Why Insurance Deductibles Exist

- Encourage responsible claim behavior

- Reduce insurer administrative costs

- Allow lower premium pricing for policyholders

- Share financial risk between insurer and customer

How Deductibles Affect Premiums

- Higher deductible → Lower premium

- Lower deductible → Higher premium

This inverse relationship is one of the most important concepts in insurance planning.

Types of Insurance Deductibles

1. Health Insurance Deductibles

You must pay medical expenses up to the deductible before insurance begins paying. High-deductible health plans (HDHPs) may include tax-advantaged Health Savings Accounts (HSAs).

2. Auto Insurance Deductibles

Commonly range from $250 to $2,000 and apply to collision or comprehensive claims.

3. Homeowners Insurance Deductibles

May be fixed amounts or percentage-based, especially in disaster-prone areas.

4. Travel Insurance Deductibles

Apply to medical emergencies, cancellations, and baggage claims during trips.

High vs Low Deductible Comparison

| Factor | High Deductible | Low Deductible |

|---|---|---|

| Premium | Lower | Higher |

| Out-of-Pocket Cost | Higher during claims | Lower during claims |

| Best For | Financially stable individuals | Frequent claim users |

| Risk Level | Higher personal risk | Lower personal risk |

How to Choose the Right Deductible

1. Emergency Savings

If you can comfortably afford the deductible, choosing a higher one may reduce premiums significantly.

2. Risk Tolerance

Lower deductibles provide predictable costs, while higher deductibles increase financial exposure during claims.

3. Claim Frequency

Frequent claims often justify lower deductibles despite higher premiums.

Common Myths About Deductibles

- Myth: Higher deductibles are always better.

Reality: They can cause financial strain without adequate savings. - Myth: Deductibles apply to all services.

Reality: Preventive healthcare may be covered before the deductible.

Tax Implications of Deductibles

In some countries, high-deductible health plans combined with HSAs offer tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses.

Real-World Deductible Example

Person A: $500 deductible, $1,800 yearly premium

Person B: $1,500 deductible, $1,200 yearly premium

Over five claim-free years, Person B saves $3,000 in premiums—but pays more upfront if an accident occurs. This shows why deductible decisions must match personal finances.

Ways to Lower Insurance Costs Safely

- Bundle multiple policies

- Maintain good credit

- Review deductibles yearly

- Use insurer discounts

Final Thoughts

Understanding insurance deductibles helps you balance affordability with protection. The right deductible reduces unnecessary premiums while keeping you financially secure during emergencies.

Review your deductible regularly as your income, savings, and lifestyle change. A smart deductible choice is not just about saving money—it’s about long-term financial stability and peace of mind.